12 . 09 . 2022

EXPERT'S VIEW Private Equity in the CEE - Hinting at Possibilities in Near Term by Driving Innovation and Inclusion

12 . 09 . 2022

Central and Eastern Europe and Private Equity

It is over three decades now that CEE enjoys continued growth and development since it started picking up in the early 1990s, and private equity has been a part of this restart since the early days. As CEE and Europe as a whole have continued to develop, investment themes and strategies have evolved, and the region has responded with innovative and appealing opportunities. The investment and value creation strategies that private equity is employing today in CEE present an exciting phase of growth and innovation in the next three to five years.

The region plays a significant role in the overall European social, political and economic landscape. Indeed, CEE includes 11 of the 27 European Union member states, and the region’s trade and industrial competencies have made it an integral part of Europe’s manufacturing and service economy. Private equity plays an important role in the region’s economy and the industry has contributed significantly to the region’s growth. Between 2003 and 2019 the industry invested nearly €29bn of capital in over 4,000 CEE companies. These PE-backed enterprises have played a significant role in bringing skills, knowledge, and know-how, especially to mid-market and growth businesses, throughout CEE.

PE/VC Investment Landscape in CEE in the Recent Past

Positioned in the heart of Europe, the CEE region offers easy access to the EU single market and its market of continually increasing consumer demand. Well-educated, skilled professionals are supported by experienced local general partners (GPs) in an environment where innovation is embraced by the government.

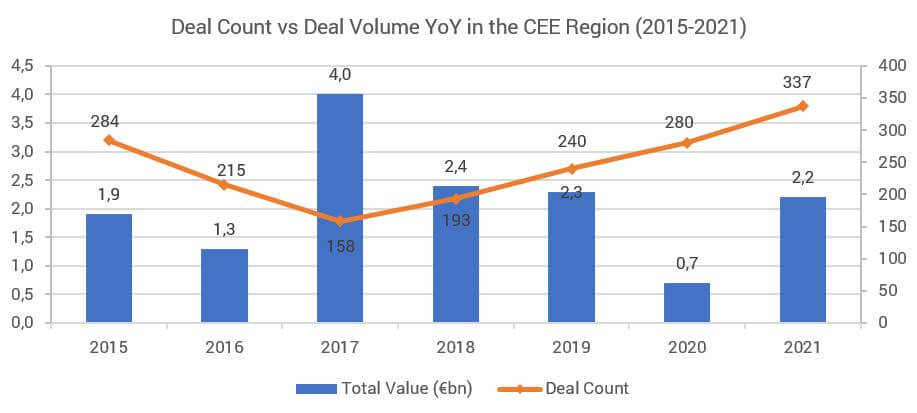

After relatively subdued deal-making activity in 2020, the aggregate deal value in the CEE region hit €2.3bn in 2021, according to S&P Global Market Intelligence – an increase of 214% YoY but still not as high as €4bn reported in 2017. In total, 337 transactions were closed in 2021, the highest tally since 2015 and 40% above the five-year average of 241 transactions per year. According to S&P Global Market Intelligence statistics, Poland was the most invested country by deal count and accounted for 31% of all completed deals in the region between 2015-2021.

Source: S&P Global Market Intelligence. Data based on reported transactions completed between 2015-2021 with targets based in the CEE region.

Based on the Global PE/VC survey conducted by Market Intelligence at the end of 2021, it has been observed that ESG is becoming an increasingly relevant investment strategy in CEE. 35% of respondents in the region said that in 2022 they were looking to invest in companies with a good ESG track record. In addition, 43% reported that their firms have started to establish ESG-related practices, which is up from 22% in 2020.

Emerging Investment Tropes in the Region

While the COVID-19 pandemic continues to impact business around the globe and potentially accelerate trends such as digitalization that will open up new opportunities for private equity, some of the key themes that are expected to continue to dominate in the region for years to come will include the following:

- Impetuous

Many CEE establishments are great businesses but are not yet great companies. They often lack the structure, processes, and resources to rapidly capture emerging opportunities. In such cases, private equity can act as the impetus for them to capture new markets, better serve existing clients and strengthen management teams. CEE GPs are experienced in unlocking the potential of these businesses to capture the underlying value and accelerate their portfolio companies’ growth and development.

- Metamorphic

Whether it is the need for new ownership as the founder ages in a region without a family succession culture or a corporate child created from shifts in global strategies, CEE private equity has proven expertise in managing ownership transitions. For the many founders who have built successful businesses, teaming up with one of the region’s experienced GPs is often the preferred way to crystalize their first fortunes and ensure future prosperity. For private equity, successfully managing the transition process raises the company’s chances of a higher multiple and a wider range of potential buyers at the exit.

- Innovative

CEE is also increasingly home to venture, technological investment, and innovation. The region’s traditionally strong technical education and skills, available human resources in areas such as programming and development, dynamic local environments, and government support programs that recognize the importance of developing innovative businesses have changed the investment landscape. Experienced GPs are now supporting these businesses and raising even more capital targeted to venture investment. The growth trend is expected to continue going forward due to the record level of VC fundraising over the last 2 to 3 years.

- Integrative

Increasing pressure from global competition and greater market complexity is demanding many CEE businesses reconsider the advantages of independence, creating opportunities for portfolio companies to be successful consolidators. Private equity’s ability to provide capital, acquisition skills, and, importantly, integration expertise can unlock these opportunities and lead to the creation of clear market champions, improving growth and margin dynamics while enhancing exit values.

Traction with Foreign Sponsors

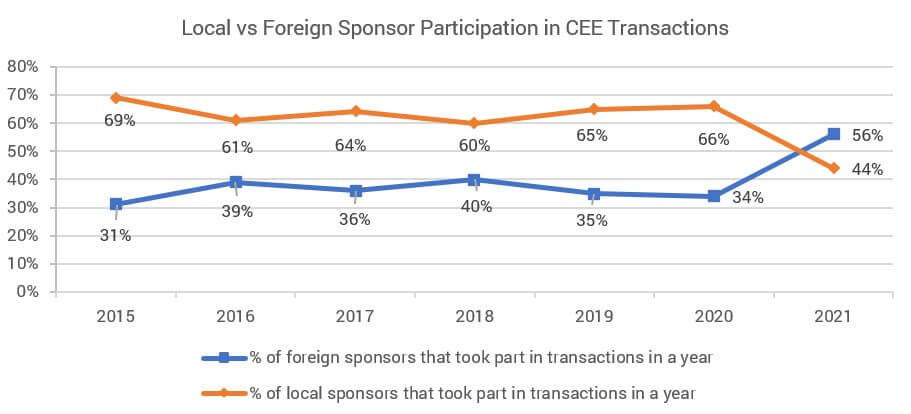

S&P Market Intelligence data shows that from 2015-2020, the majority of sponsors YoY in CEE deals were domestic PE/VCs at 61% on average. However, in 2021, foreign sponsors accounted for 56% of the total number of investors participating in transactions, which is a 168% growth over 2020. 2021 also marks the first year when the number of foreign PE/VCs participating in CEE transactions exceeded the number of domestic sponsors.

Source: S&P Global Market Intelligence. Data based on reported transactions completed between 2015-2021 with targets based in the CEE region.

When it comes to reported deal value, foreign investors were clearly in the lead in the period 2015-2019; however, in 2020 domestic sponsors started bringing more money into the transactions, which increased the value of mixed transactions. As plenty of fresh capital is eagerly awaiting to be deployed, Market Intelligence data shows that the CEE region is gaining momentum with GPs on the lookout for new opportunities which can yield higher returns. However, it is no denying that investing in an economically and geopolitically unstable location requires skill, expertise, and the right data to circumnavigate the different cultures, structures, and business activities in the vast region of CEE.

Impact Of the Russia-Ukraine Conflict

The private equity community is still assessing how the Russia-Ukraine conflict could impact private markets portfolios, as a key cause of concern is that the valuations of underlying companies could take a hit from geopolitical uncertainty. In the recent past, the public markets have been jittery, as they grapple with the prospects of interest rate hikes by the central banks to stifle inflationary pressure. The Russia-Ukraine conflict has only exacerbated this volatility. Certain direct consequences to the portfolio could also come in the form of higher energy prices, potential supply chain issues, and capital market developments.

However, as long as investors have a long-term focus on the underlying performance and look at the long-term prospects of the companies they invest in, they will see more positives. The softening of valuations across markets may create interesting buying opportunities for many PE firms, and many may decide to increase their commitment to additional PE/VC funds.

Many PE firms are optimistic that there will continue to be plenty of investment opportunities in the region in the medium and long term, as CEE remains a dynamic market, packed with entrepreneurial start-ups, maturing businesses with international ambitions, and highly educated and skilled individuals determined to make a positive mark. Some of them think that the CEE region is likely to benefit from the inward investment as Russian exporting manufacturers are hit by trade sanctions.In the long-term, once the war is over, firms in the region will be well placed to benefit from the billions of euros worth of work that will be needed to reconstruct Ukraine. Until then, with global PE firms taking a wait-and-see approach, local buyout houses in the CEE region are likely to dominate deal activity in the months ahead. Even in war-torn Ukraine, where battles are still raging daily, local PE houses continue to do deals.

In April 2022, a US-domiciled PE firm Horizon Capital, which has been one of the most active investors in Ukraine in recent years, said that its $200m emerging Europe growth fund III acquired a minority stake in a Kyiv-based IT services business called Miratech.

Conclusion

As CEE and Europe as a whole have continued to develop, investment themes and strategies have evolved, and the region has responded with new and exciting opportunities. There are numerous advantages for investors ready to expand operations into Central Eastern Europe, as the CEE boasts a thriving start-up market, especially in tech. Strong founding teams and a large pool of highly skilled developers have helped create a booming start-up space, and early adopters can afford to be highly selective. Financial returns are relatively robust, buoyed by low starting valuations, and investors enjoy a high level of impact and collaboration.

Today, the region’s funds represent an important component of European private equity exposure. They provide access to a region that continues to demonstrate compelling private equity fundamentals and attractive returns as well as a clear and evidenced macro convergence story that will continue to drive superior growth for the foreseeable future. Thanks to successful EU integration, CEE offers investors developing market opportunities but with developed market risk.

Did you like the article?

Sourabh has close to 14 years of experience, working extensively with private equity, investment banking, and corporate clients in the areas of M&A, deal origination, commercial due diligence, and value creation.

Do you want to exchange knowledge or ask a question?

Write to me : Sourabh Biswas page opens in new window

Optimization means success of PE/VC project. Try out FORDATA VDR free for 14 days

START NOW Get your trial version for free-

01 . Expert coverage from Tallinn: FORDATA at Baltic M&A & Private Equity Forum 2025

In May 2025, Piotr Miszczyk, a member of FORDATA’s sales team, represented the company at the prestigious Baltic M&A and Private Equity Forum event in Tallinn. The following is an expert summary of the visit – from the perspective of the market, the VDR sector and strategic discussions with representatives of major consulting firms.

02.06.2025

-

02 . Cautious optimism for M&A in CEE amid global challenges

Much like the rest of Europe, CEE has been moving in line with global trends, experiencing a downturn in economic activity. The first half of 2024 proceeded largely as expected, with no major surprises in the mergers and acquisitions industry.

12.07.2024

-

03 . DACH M&A in 2024 - will the rising wave return?

Explore how dealmakers in the DACH region continue to leverage M&A as a strategic tool amidst evolving business landscapes, including the impact of AI and sustainability. What does 2024 hold for this dynamic market?

03.04.2024

-

04 . Trends in M&A market in CEE in 2024 through the eyes of buyers

Market sentiment in Central and Eastern Europe (CEE) M&A market in 2024: a blend of cautious optimism, enthusiasm, and significant risk aversion.

08.03.2024

-

05 . Expert Comment from Fordata on the Real Estate Index Poland, 4Q 2022 report

In the last quarter of 2022 and the first months of 2023, we finally witnessed a revival in the real estate market. What does the real estate market look like?

25.05.2023

-

06 . The war in Ukraine and its repercussions

The unprovoked full-scale invasion of Ukraine launched by the Russian aggressor on 24 February 2022 has had tremendous local and global repercussions in all areas of life.

10.11.2022

-

07 . Why is it worth investing in a professional VDR?

Investing in the purchase of a business is a risky undertaking. Therefore, it is extremely important to have a group of advisers by your side who will support a…

25.04.2022

-

08 . Romanian market in 2022 - M&A and the domestic specificity

Romania is among the CEE region’s fastest growing economies with an estimated GDP growth rate of 4.2% in 2022. In 2021, the…

11.04.2022

-

09 . ESG: A new Framework in the Making - New requirements and how they (probably) fit into each other

Sustainability and activities aimed at reducing the carbon footprint are currently at the top of the political agenda in virtually every major ec…

16.12.2021

-

10 . Good practices in the field of compliance - what fintechs can learn from traditional financial institutions

Aleksandra Kopeć focuses on compliance and points out the differences between their application in traditional finance and fintechs.

01.09.2021

-

11 . Germany's Transparency Register - what does it mean to companies?

Dr. Jan J. Kruppa explains how EU AML Directives apply to German law and what new regulations bring to the local entities.

24.08.2021

-

12 . PE/VC funds' activity in H1 2021 - The USA and the EU

Harmeet Dhiman takes a look at PE/VC activity in the United States and Europe. How is it after the first half of the year 2021?

22.07.2021

-

13 . What are the challenges of the FinTech industry?

The challenges of fintech are not just online security. What is fintech after the pandemic like, explains Aleksandra Kopeć, financial lawyer.

18.05.2021

-

14 . The role of the CFO in mergers and acquisitions - has it changed?

Financial directors have faced the big challenge of managing company’s funds in the uncertain reality caused by the coronavirus …

22.03.2021

-

15 . Audit during the pandemic - how has it changed?

The epidemic has had a significant impact on the economy and the functioning of companies, therefore its effects…

27.01.2021