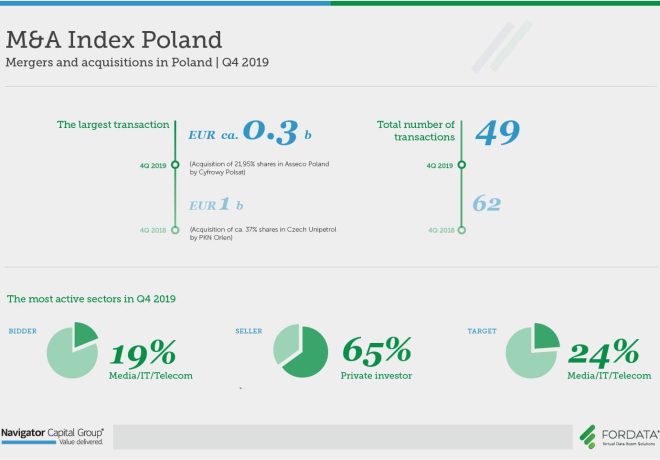

49

total number of transaction

0.3 b

the largest transaction (EUR)

49 %

popularity of Virtual Data Room

The fourth quarter of 2019 resulted in the frequency of use of Virtual Data Room systems in mergers and acquisitions at high 49%. We are pleased that once again we could support the consolidation processes of Polish companies. The FORDATA system was used by parties in a number of transactions, including the sale of Tomma Diagnostyka Obrazowa to PZU Zdrowie and the purchase of heaters manufacturer Kospel by Viessmann. SEE THE BENEFITS OF USING VDR

Do you want to exchange knowledge or ask a question?

Alicja Kukla-Kowalska Expert from FORDATA

M&A Index Poland Reports

![]()

FORDATA is a pioneer on the Polish capital market. Based on Virtual Data Room technology, we support our clients in managing documents and communication during complex transactional processes, ie. M&A, IPO transactions, private equity investments, restructurings, projects associated with obtaining financing and privatizations in Poland and other countries of Central and Eastern Europe.

FORDATA systems increased safety and efficiency of hundreds of different types of transactions with a total value of over PLN 40 billion.

![]()

Navigator Capital along with Dom Maklerski Navigator (Navigator Brokerage House) is the leading independent financial adviser, specializing in mergers and acquisitions and public and private issues of stocks and bonds.

During 12 years of its market presence, Navigator Capital Group conducted over 70 transactions, of over 6 billion PLN total value.

Through cooperation with international network of advisory firms associated in the Pandion Partners, Navigator Capital effectively handles international transactions.