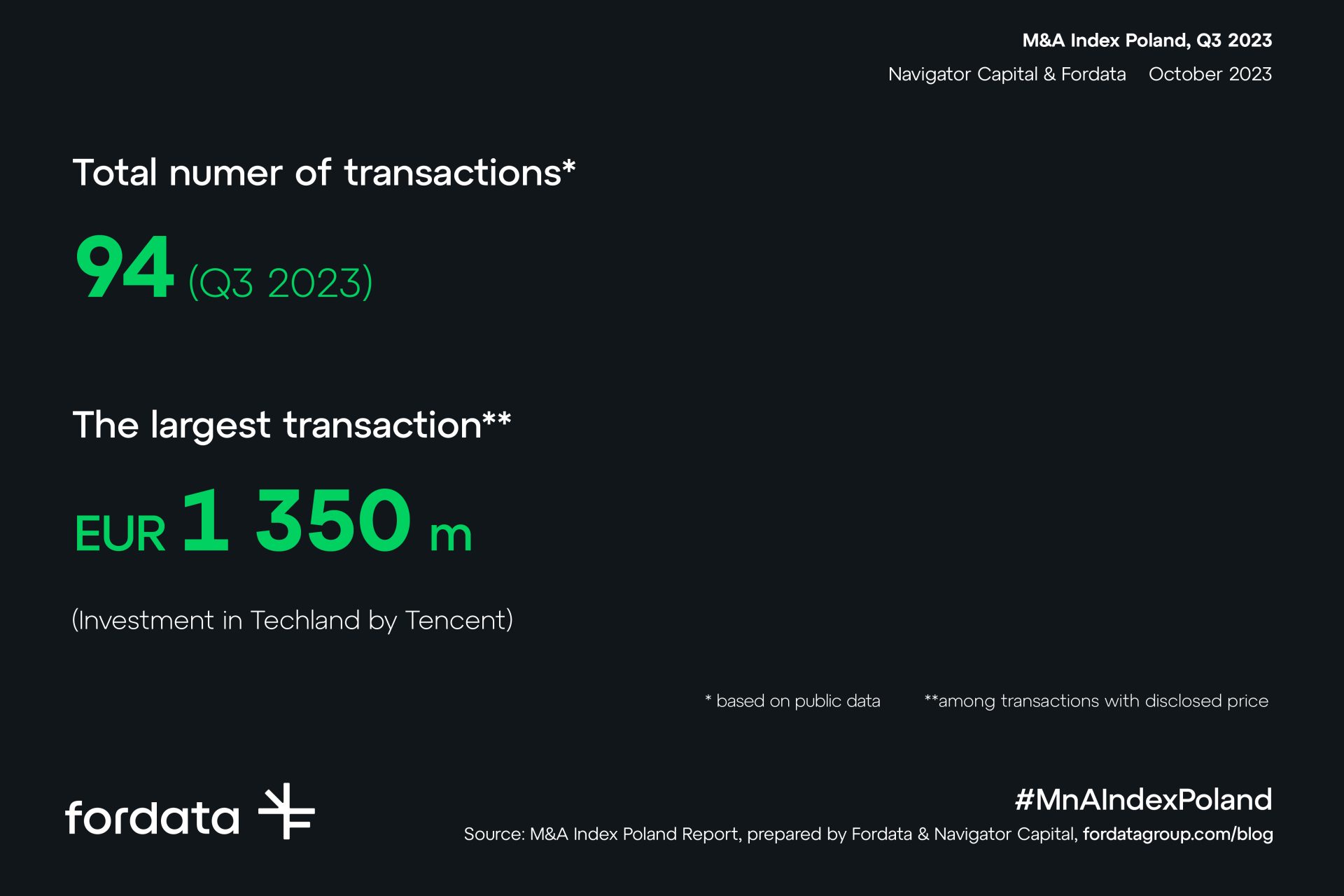

Despite the still ongoing war in Ukraine and the resulting economic and geopolitical problems, the Polish M&A market will remain active in the coming months. Although the pace of transactions may fluctuate somewhat, the end of the year is predicted to be a time for investing, especially in the new technology sector. VC investors will look to support Polish startups and companies will increasingly need to incorporate ESG principles into their business strategy. It is also worth monitoring the development of regulations concerning the RES industry, as this may have an impact on investments in the energy sector.

Do you want to exchange knowledge or ask a question?

Marcin Rajewicz, expert from FORDATA

M&A Index Poland Reports

![]()

FORDATA is a pioneer on the Polish capital market. Based on Virtual Data Room technology, we support our clients in managing documents and communication during complex transactional processes, ie. M&A, IPO transactions, private equity investments, restructurings, projects associated with obtaining financing and privatizations in Poland and other countries of Central and Eastern Europe.

FORDATA systems increased safety and efficiency of 1200+ of different types of transactions with a total value of over PLN 42 billion.

![]()

Navigator Capital along with Dom Maklerski Navigator (Navigator Brokerage House) is the leading independent financial adviser, specializing in mergers and acquisitions and public and private issues of stocks and bonds.

During 12 years of its market presence, Navigator Capital Group conducted over 70 transactions, of over 6 billion PLN total value.

Through cooperation with international network of advisory firms associated in the Pandion Partners, Navigator Capital effectively handles international transactions.