The situation in the energy sector in Poland is changing dynamically. It is estimated that by 2030, 50% of Poland's energy needs will be covered by renewable energy sources (RES). Offshore and onshore wind farms, hydrogen power plants and photovoltaics will play a special role here. We can also expect further foreign investment - Industriens Pension and Better Energy are planning to invest more than EUR 800 million in photovoltaics in Poland, Denmark and Sweden. Although this industry is constantly evolving, RES and hybrid solutions will certainly play a key role in the years to come.

Do you want to exchange knowledge or ask a question?

Marcin Rajewicz, expert from FORDATA

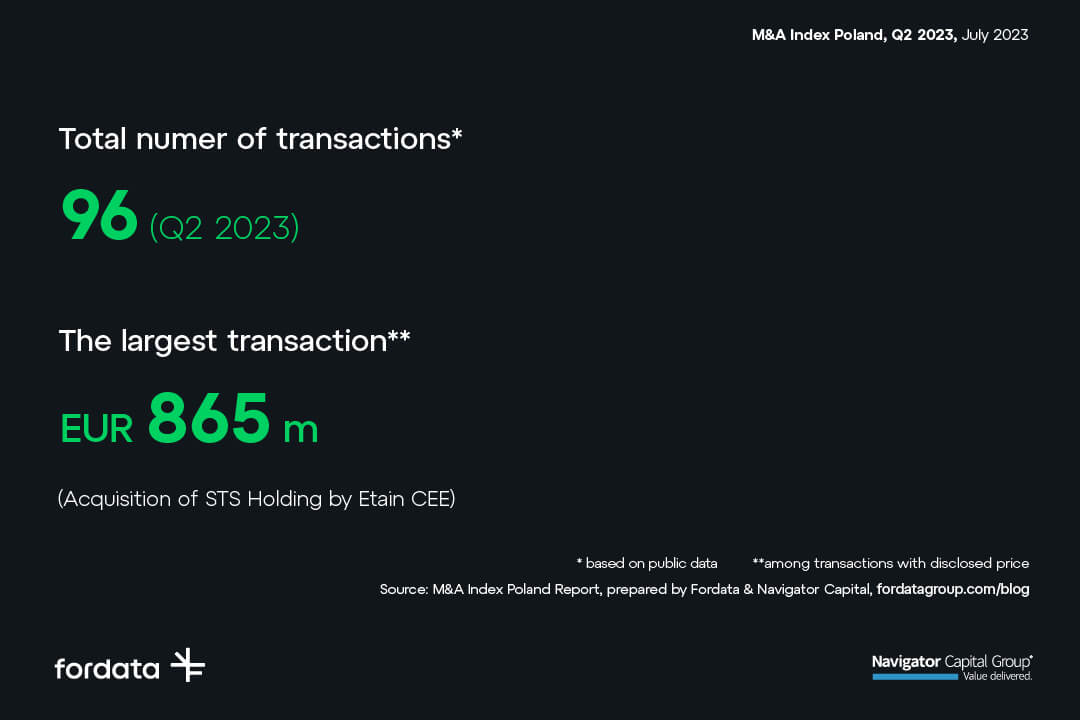

M&A Index Poland Reports

![]()

FORDATA is a pioneer on the Polish capital market. Based on Virtual Data Room technology, we support our clients in managing documents and communication during complex transactional processes, ie. M&A, IPO transactions, private equity investments, restructurings, projects associated with obtaining financing and privatizations in Poland and other countries of Central and Eastern Europe.

FORDATA systems increased safety and efficiency of 1200+ of different types of transactions with a total value of over PLN 42 billion.

![]()

Navigator Capital along with Dom Maklerski Navigator (Navigator Brokerage House) is the leading independent financial adviser, specializing in mergers and acquisitions and public and private issues of stocks and bonds.

During 12 years of its market presence, Navigator Capital Group conducted over 70 transactions, of over 6 billion PLN total value.

Through cooperation with international network of advisory firms associated in the Pandion Partners, Navigator Capital effectively handles international transactions.