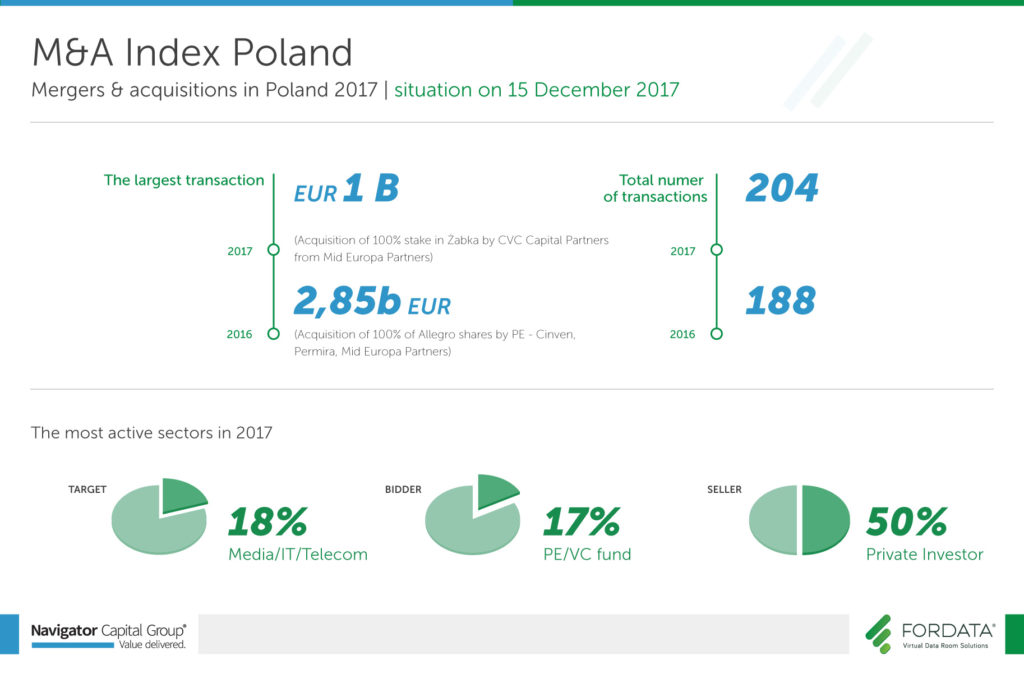

204

total number of transactions

4.3 mld

the largest transaction (PLN)

Throughout 2017, transactions between Polish entities dominated. Foreign investors accounted for 27% of buyers and represented mainly European countries. We noted further transactions involving Asian investors: poultry group Superdrób acquired Thai conglomerate Charoen Pokphand Foods (CPF) as an investor, while Chinese food giant WH Group, through the US company Smithfield Foods, which it owns, acquired stakes in abattoirs owned by Pini Polonia. The Chinese in Poland also have stakes in companies with production facilities such as Animex, Agri Plus and Agri Plus Feed. This year shows that the Chinese are increasingly bold in buying Polish entities. We predict that in 2018 we will see further Asian investments in the domestic market.

Do you want to exchange knowledge or ask a question?

Alicja Kukla-Kowalska expert FORDATA

M&A Index Poland Reports

![]()

FORDATA is a pioneer on the Polish capital market. Based on Virtual Data Room technology, we support our clients in managing documents and communication during complex transactional processes, ie. M&A, IPO transactions, private equity investments, restructurings, projects associated with obtaining financing and privatizations in Poland and other countries of Central and Eastern Europe.

FORDATA systems increased safety and efficiency of hundreds of different types of transactions with a total value of over PLN 40 billion.

![]()

Navigator Capital along with Dom Maklerski Navigator (Navigator Brokerage House) is the leading independent financial adviser, specializing in mergers and acquisitions and public and private issues of stocks and bonds.

During 12 years of its market presence, Navigator Capital Group conducted over 70 transactions, of over 6 billion PLN total value.

Through cooperation with international network of advisory firms associated in the Pandion Partners, Navigator Capital effectively handles international transactions.